Under Pressure.

Contents

Executive Summary

What you need to know

If 2025 has a challenge for B2B marketers, it's this: Do more with the same. Or less.

APAC marketers are under pressure to hit bigger pipeline goals with flat or shrinking budgets. 59% of these marketers have the same or less budget and more than half are putting budget into demand gen over brand. Worryingly, just 37% believe their current budget will get them there - yet most aren't doubling down on the areas that will truly make a difference.

This Green Hat & 6sense study of 155 APAC B2B marketers reveals a profession in tension - with investment areas not lining up with what marketers say they value most.

The report unpacks where APAC marketers are investing but also where they're not. And it does so through the lens of our APAC B2B Buyer Journey Research Report, which tells us:

- The average buying group comprises 12.8 people who will only reach out to vendors 73% through a 13 month buying journey.

- 82% choose the first vendor they engage with.

- More than half of the buying group are ‘hidden' buyers - they can influence or veto decisions but often aren't directly targeted by marketing.

The disconnect between priority and budget allocation is real:

- Brand priority vs. budget share

Brand building ranks #1 in importance yet demand generation is still getting more budget (and increasing faster).Why keep favouring short-term performance when brand drives early preference and long-term growth? - AI confidence vs. budget commitment

80% of marketers are confident in AI having a positive impact on marketing goals - but only 29% have carved out budget for it.If AI has potential to unlock efficiency and scale, why isn't it being funded more deliberately? - ABM maturity gap

55% of APAC marketers run ABM programs vs. 77% in the US.Why is a region so focused on growth lagging behind on the most fundamental form of account-centric marketing?

What does this mean for marketers?

Marketers are between a rock and a hard place.

Tight budgets, rising revenue targets clash with long buying cycles, and self-directed buyers who only reach out late in the buying cycle. In the face of this pressure, marketers report defaulting to activities that drive short term gains at the cost of longer-term goals.

Success in 2025-26 will come down to a marketer's ability to:

-

Align budget allocations with long buying cycles:

Even though content, brand and ABM are seen as strategic, many teams still over-index on short-term tactics such as lead gen - often because they're easier to measure against a backdrop of increased pipeline demands - even if they don't reflect how B2B decisions are made. -

Build a brand that's front of mind with buyers:

From our research, nearly everyone in the buying group knew the winning vendor's brand before engaging them. Brand equity and mental availability are what get you shortlisted, especially when 82% of buyers engage their preferred vendor first. Brand also plays a key role in overcoming buyer indecision. -

Get more out of Account-Based Marketing (ABM):

You're influencing a buying group of 13, many of whom you'll never meet. ABM, not demand gen, is the only model that matches how B2B buying decisions are really made. -

Make AI the new competitive edge:

It's not just about which tools you use. It's how you create more content, optimise campaigns faster, get richer insights, and work at a pace your competitors can't match. When budgets are tight, AI can be your efficiency engine.

This report highlights how you can get more out of your 2025-26 budgets by aligning investments with areas that will drive results.

We recommend you read this report alongside the APAC B2B Buyer Journey Research Report that unpacks how B2B buying teams are operating in this region.

Part A

Marketing budget priorities

The illusion of stability: a story of rising revenue goals, reallocation and misalignment.

1. Budget stability with pockets of growth

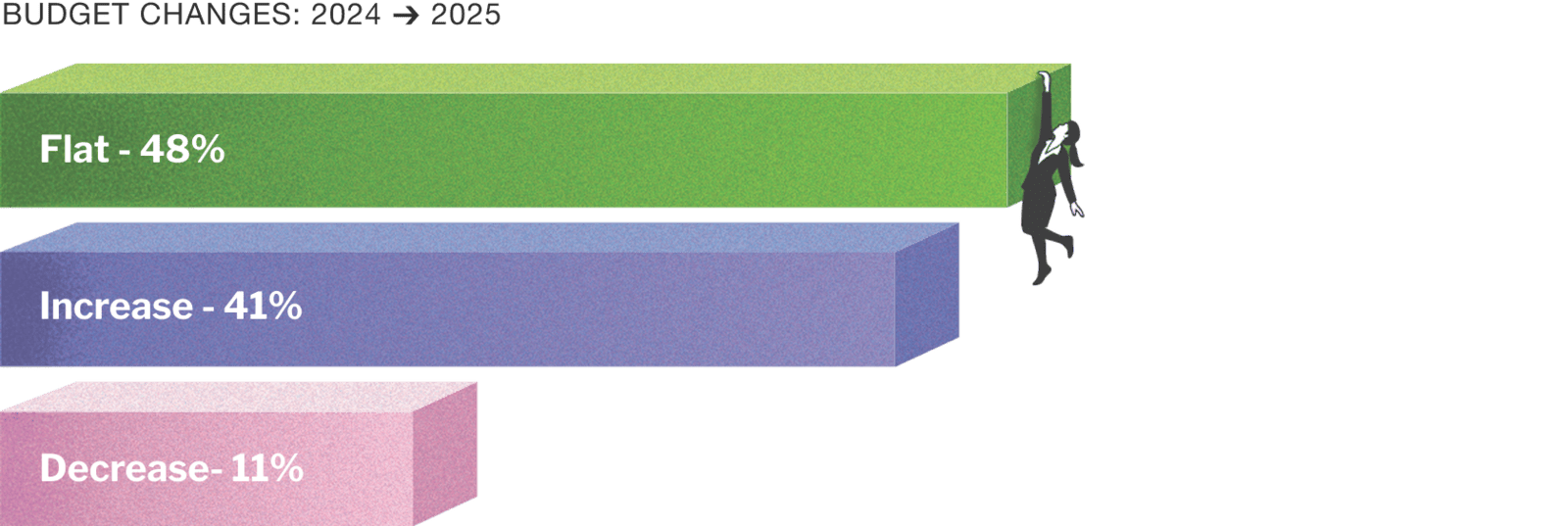

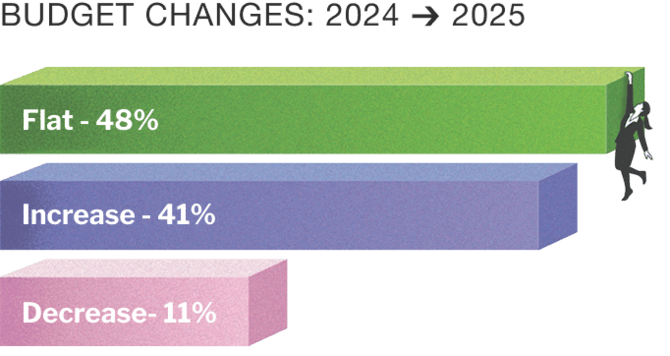

Despite global economic headwinds, most APAC B2B marketers expect budget stability or modest growth in 2025.

Most marketers expect budgets to hold steady or modestly grow in 2025

For those lucky enough to receive budget increases, they grew by 14% on average. For those who had decreased budgets, the dropped by an average of 23%.

However, only 37% believe their 2025 budget will be sufficient to meet performance goals - leaving 63% either unsure or pessimistic.

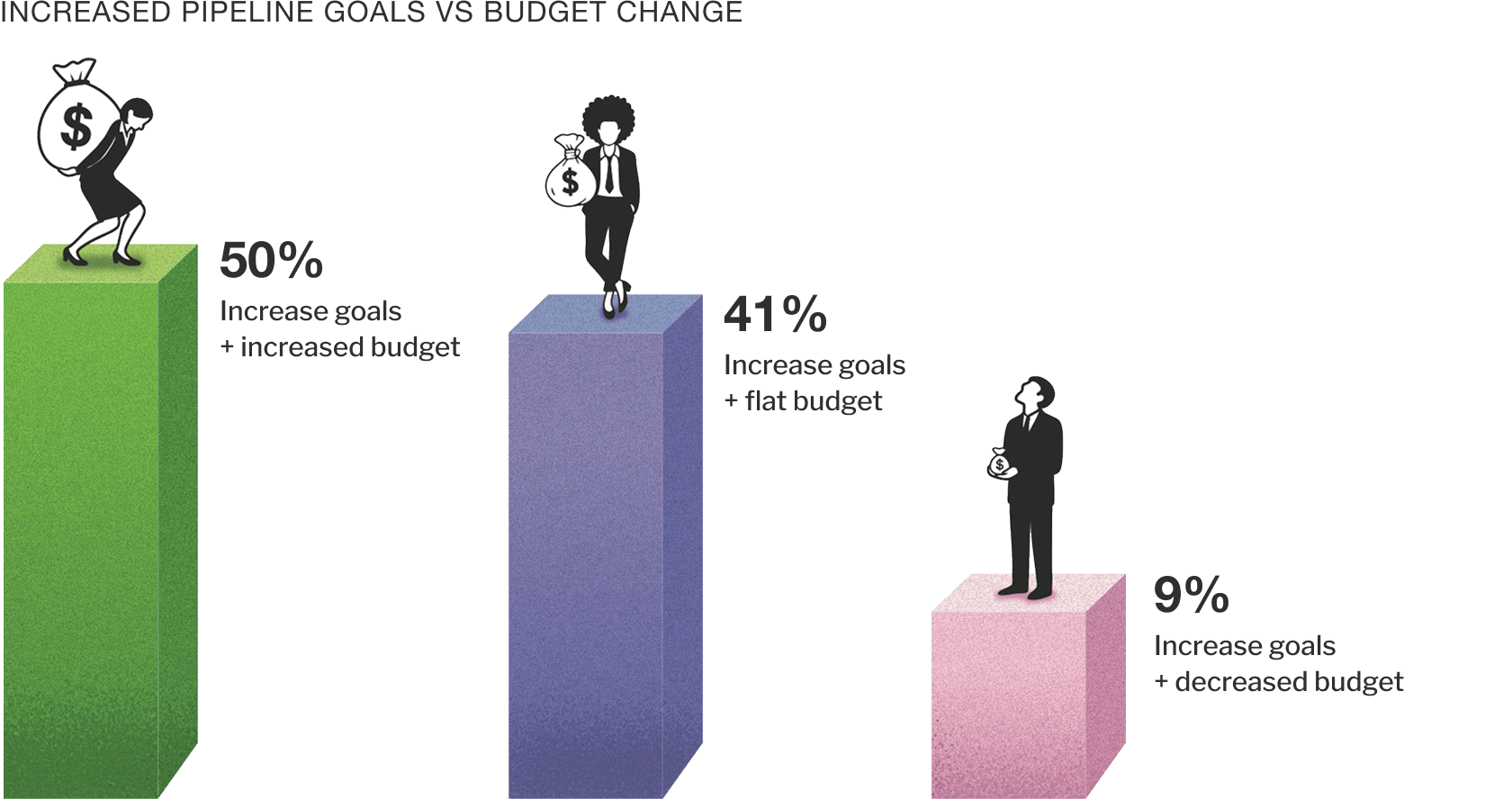

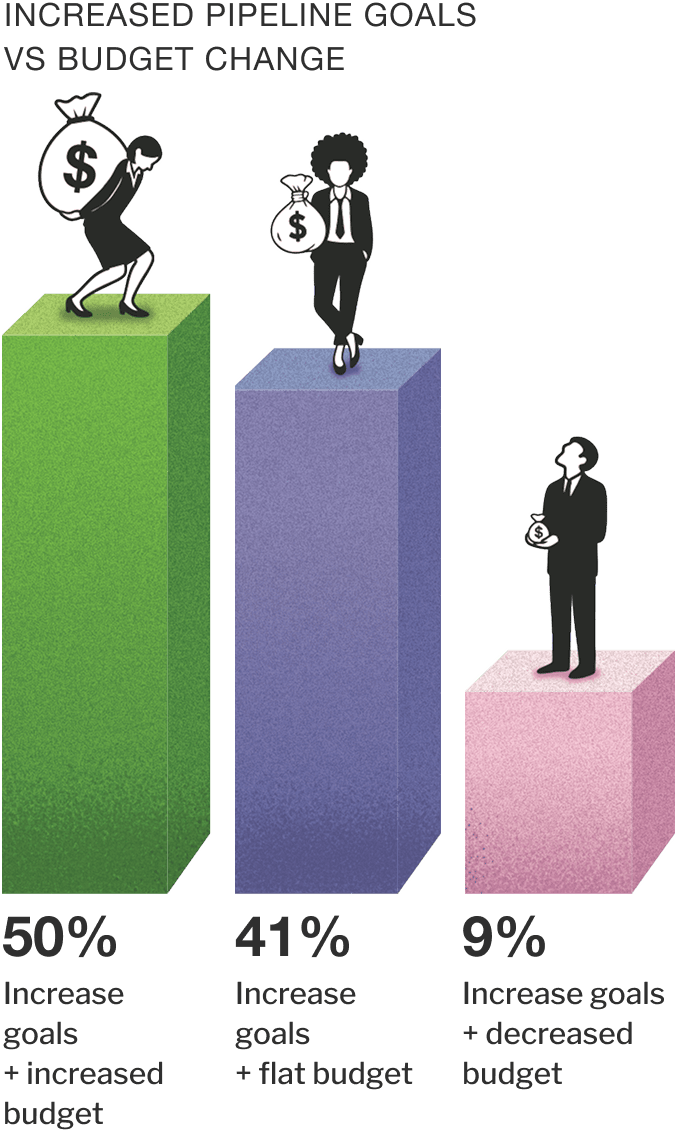

2. Revenue goals vs budget reality

Many marketers are chasing bigger pipeline goals without budget growth

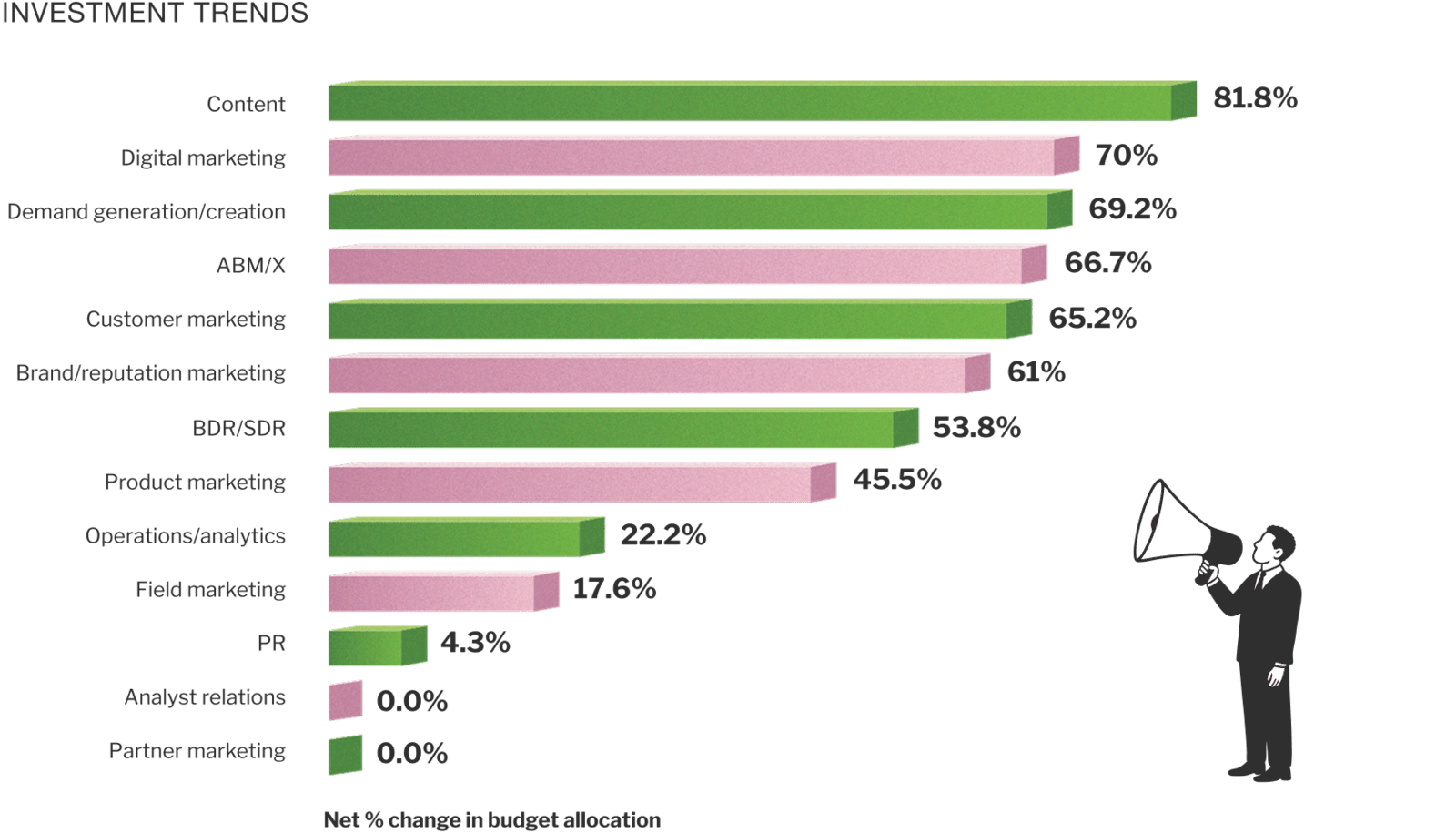

3. Investment trends by marketing activity

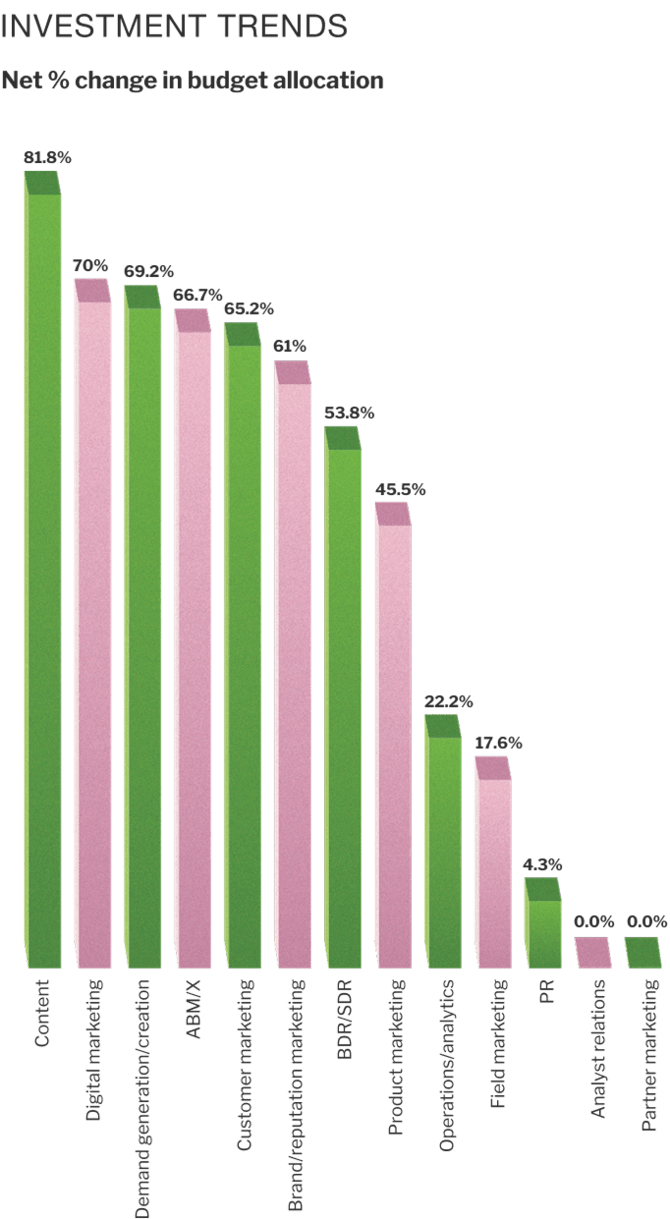

We asked marketers how they plan to distribute their budget during 2025. Activities seeing the highest net increase in investment (total respondents increasing less total respondents decreasing) include:

Content marketing

Digital marketing

Demand generation/creation

ABM/X

Brand

Customer marketing

Despite nearly half of APAC marketers operating with flat overall budgets, the vast majority are shifting investment toward performance-driven areas (e.g., demand generation). Interestingly, those who received budget increases are also choosing to invest in these same areas.

Marketers are actively changing their channel/activity mix

4. Brand vs demand: is the balance right?

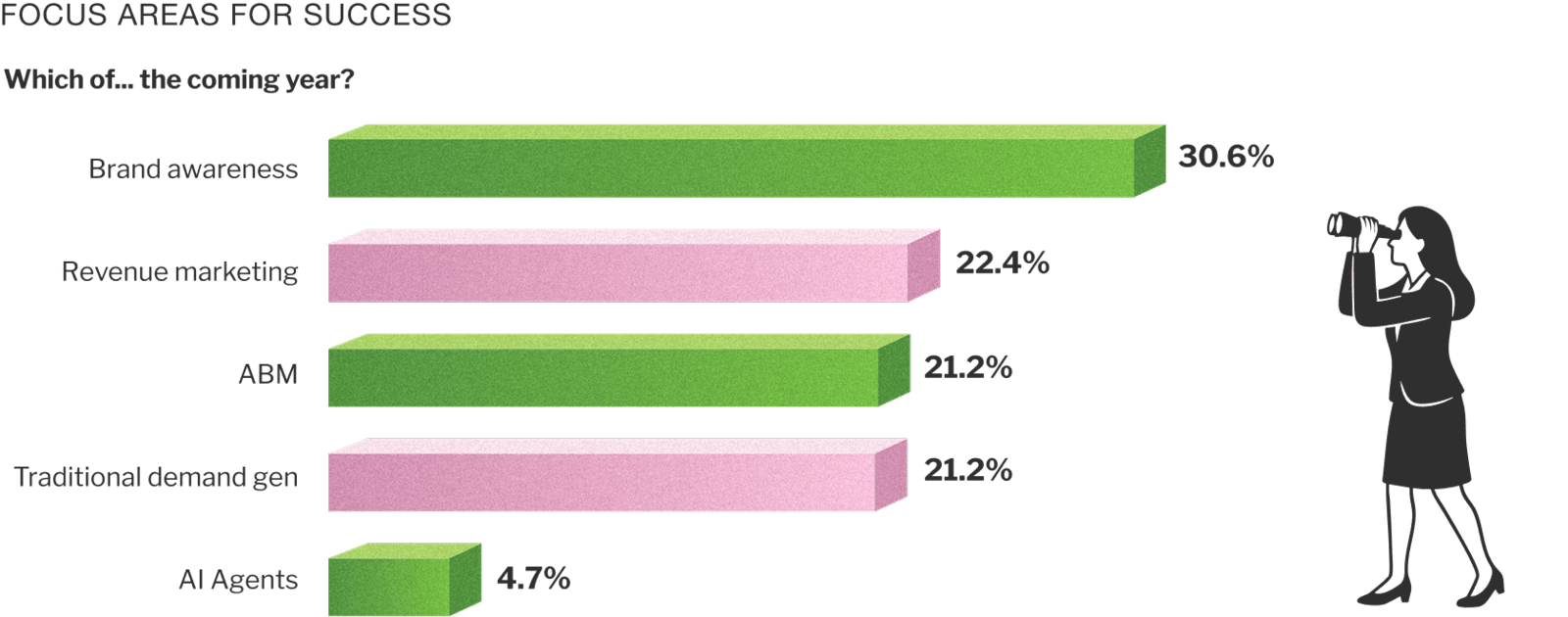

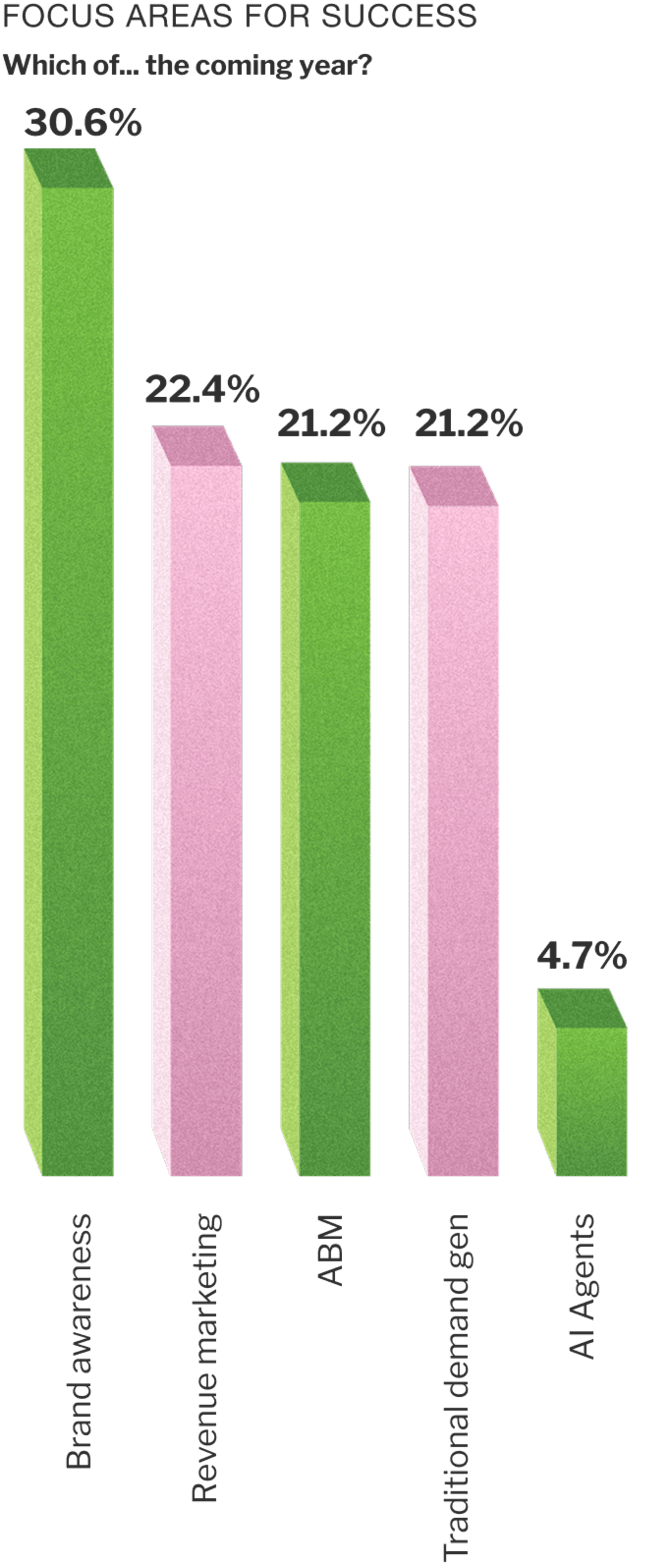

So here lies the disconnect - despite budgets being channelled towards demand generation and revenue marketing:

Marketers rank brand as #1 in terms of importance.

But actions speak louder than words. Consider the below:

Brand awareness ranks as the most important focus for success in APAC

5. ABM adoption: room for growth

More than half of APAC marketers have adopted ABM but significant room for growth remains. While ABM has crossed into mainstream awareness, many marketers are still in early-stage adoption or trying to scale.

Reallocation trends suggest some marketers are using budgets to build ABM capabilities incrementally rather than securing additive funding:

Part B

AI in the budget mix

Is confidence in AI all talk, little action?

1. State of AI budgeting

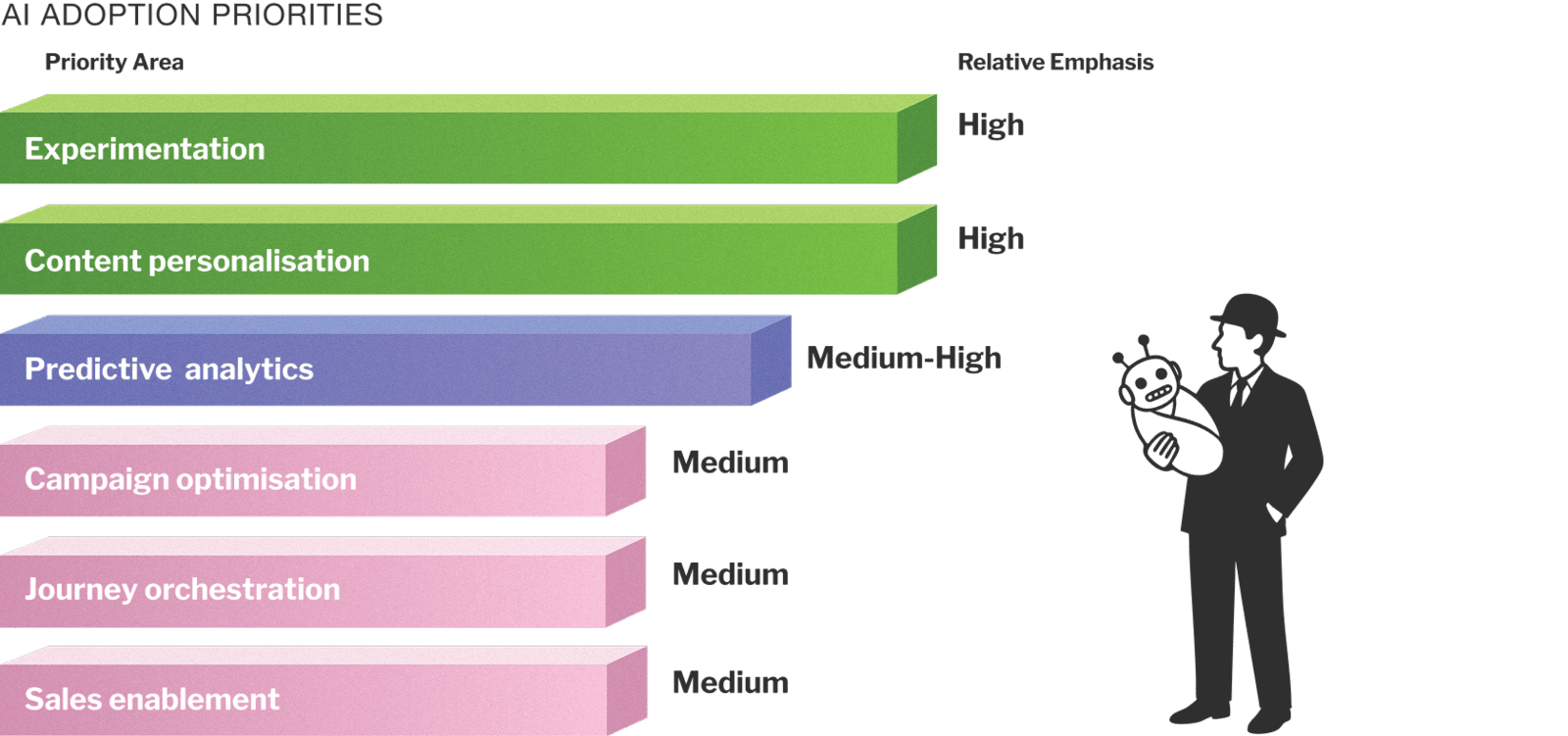

AI is starting to feature in APAC marketing strategies - but actual investment is lagging behind confidence and intent.

Only 29% of APAC marketers have a dedicated budget for AI in 2025 - well below the 52% reported in the US. Among those investing:

This signals that while AI is on the radar and being employed in some fashion, it’s not yet seen as business-critical – more experimental than foundational. But with 59% of marketers operating with flat or less budget, and 63% lacking confidence in achieving their goals, AI could (and should) be a lever for efficiency, not just testing.

Early AI investments are spread across functions

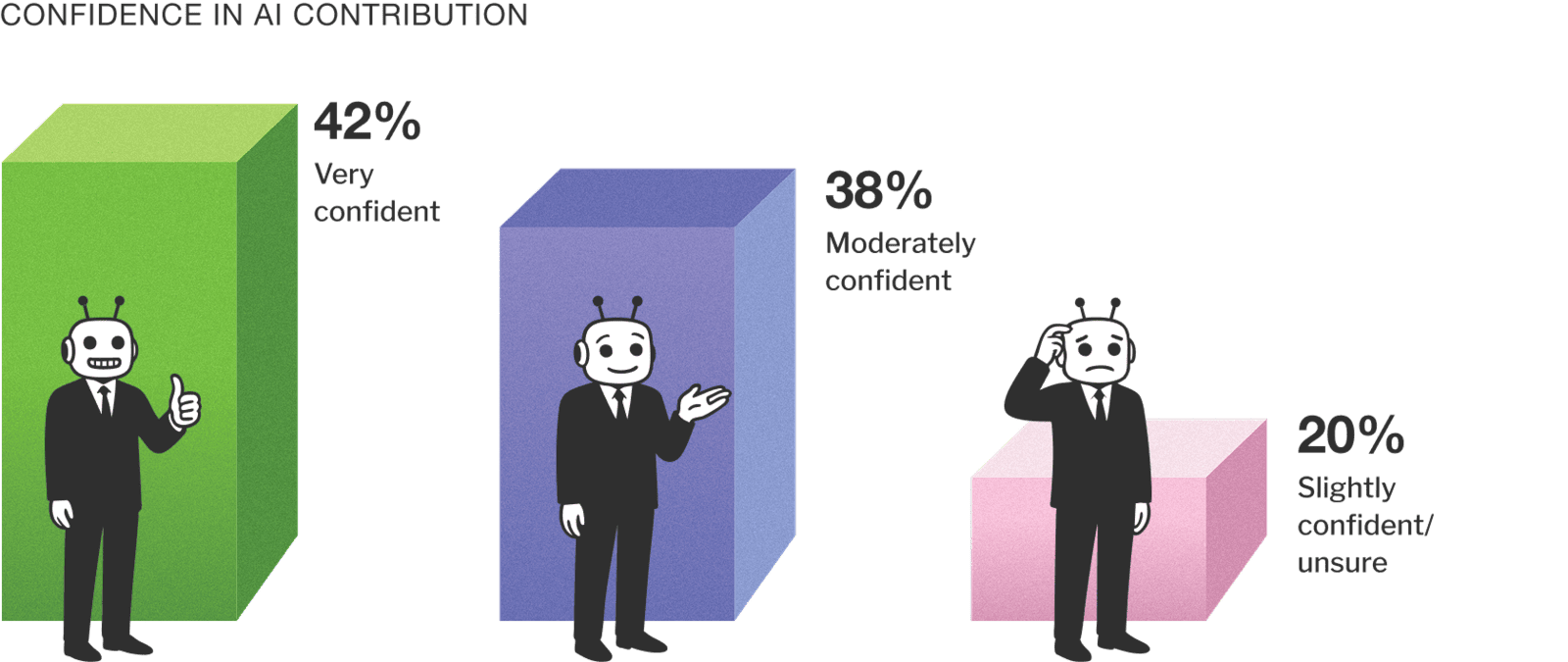

2. Confidence in AI contribution

Despite limited budget allocation, belief in AI's value is growing quickly.

Marketers growing more confident in AI helping achieve goals

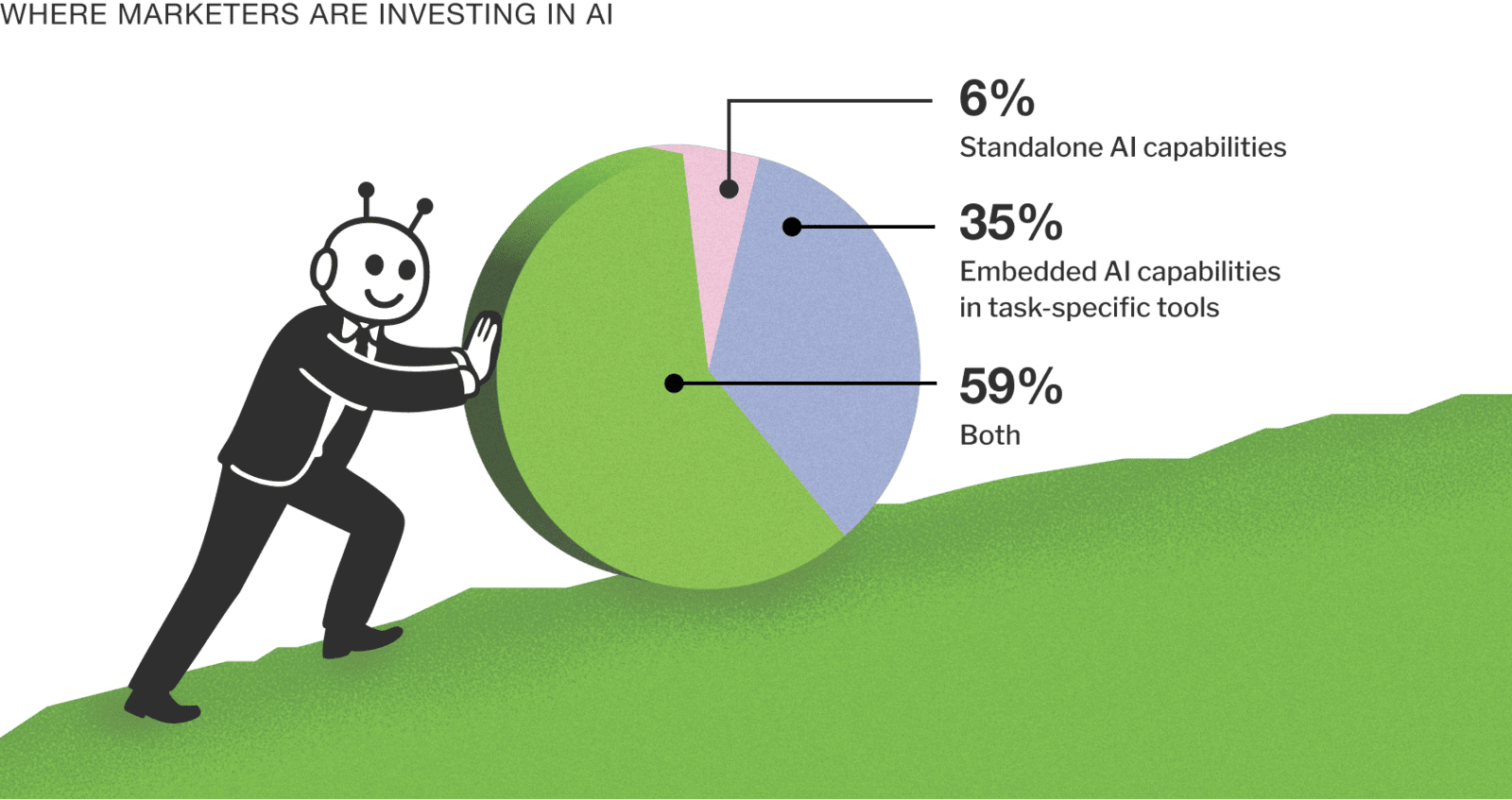

3. Martech selection and embedded AI

Even in the absence of dedicated AI budgets, buyers are shifting their evaluation criteria to favour platforms with embedded AI capabilities.

This is a pragmatic move. AI isn't just about deploying new tools, it can also be upgrading what you already use. Some marketing teams are acquiring AI by stealth: through CRM upgrades, content platforms, campaign tools and analytics engines that now come AI-enhanced by default.

Marketers favour embedded AI alongside standalone tools

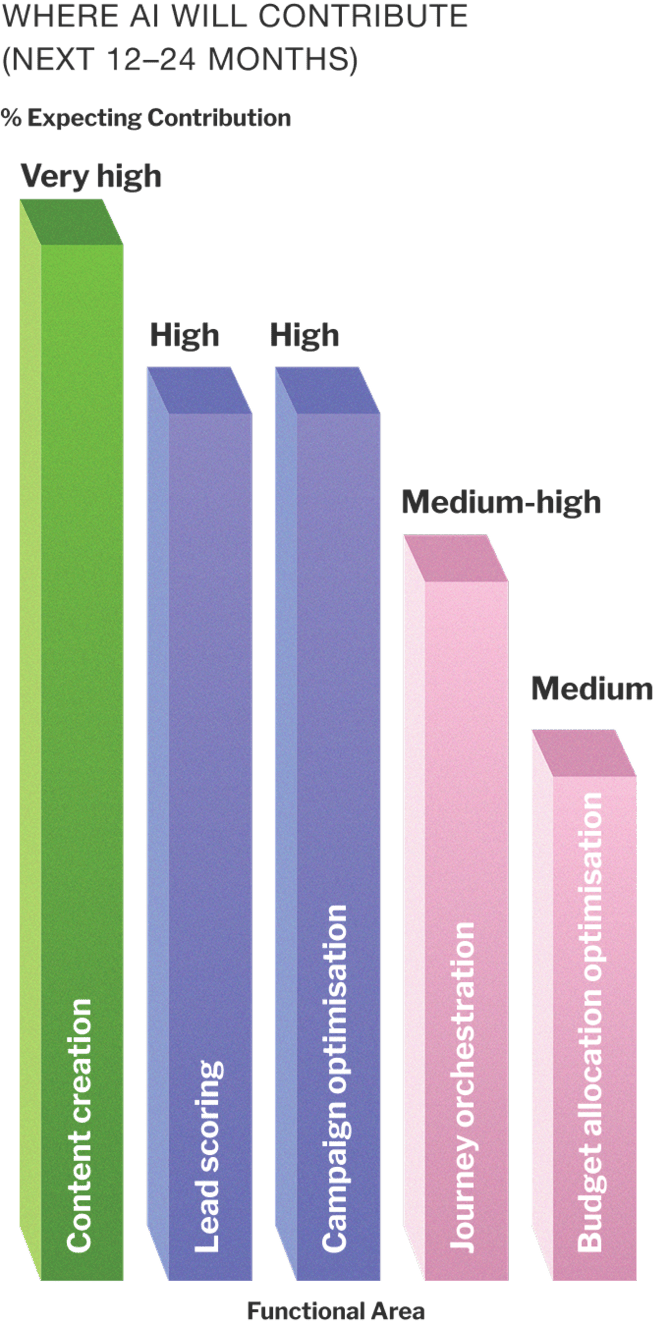

4. Expected AI impact (12-24 months)

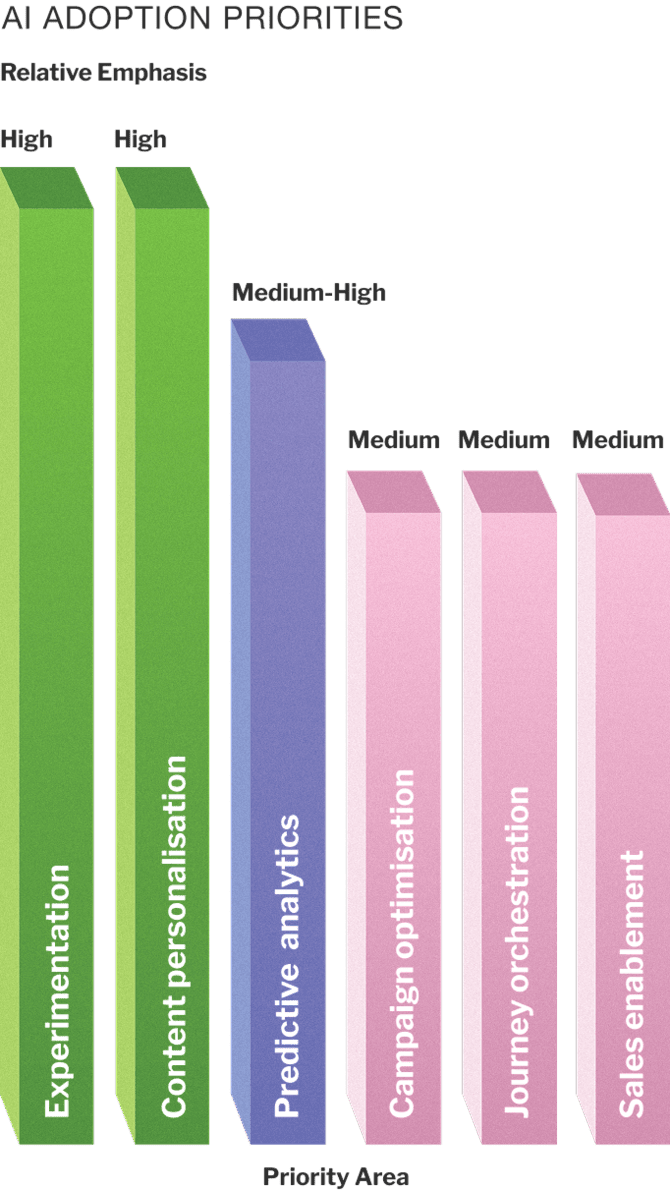

Marketers see AI touching every major function in the near term, particularly:

Content creation

Campaign optimisation

Journey orchestration

Budget allocation decisions

Lead scoring and predictive analytics

Are marketers building the operational frameworks to support that impact? Strategy, training, and governance need to be implemented alongside aspiration and implementation.

AI expected to touch every major marketing function

Part C

Actionable moves for B2B marketers

Turn words into action. Make your move today.

APAC marketers are caught in a tightening squeeze - rising pipeline goals, constrained resources, and technological disruption. But amidst the pressure, there is opportunity.

Based on the findings, here are 8 key actions B2B marketers should consider in 2025 into 2026:

Reallocate budgets strategically

Prioritise brand for long-term pipeline

Brand still needs local relevance

Tracking and measuring brand investment

ABM is a competitive driver

Pilot AI where the impact is clear … and move quickly.

Embed AI into technology and vendor decisions

GEO is the new SEO

2025 will test the resilience and resourcefulness of B2B marketing leaders across APAC.

While budgets remain tight or flat for many, expectations for revenue contribution continue to rise - forcing marketers to make smarter, faster, and more focused investment decisions.

In this context, the most successful marketing teams in 2025 going into 2026 won't be the ones with the biggest budgets - but those that can balance short-term results with long-term growth, reallocate decisively into programs that can provide competitive advantage (e.g., ABM), and operationalise innovation (including AI) without waiting for perfect conditions.

Part D

Research methodology

Who, what and how we did it.

This research study was conducted by Green Hat, APAC's leading B2B marketing consulting and research firm, in conjunction with 6sense Research.

A total of 155 senior B2B marketing professionals responded via on online quantitative survey during April-May 2025.

The US data was based on a 6sense study with 392 B2B marketers in the late months of 2024.

Roles represented

- CMOs, Marketing Directors, Heads of Demand Generation, Brand Managers, Marketing Operations Leads, and others

Primary industries covered

- Technology, Financial Services, Professional Services, Manufacturing, SaaS/Cloud

Company size

- Small (under 200 employees): 23%

- Mid (200-1000 employees): 42%

- Large (1000+ employees): 35%

Geography

- Companies primarily headquartered across Australia, Singapore, India, Japan, and broader APAC

Download the research.

We believe content should be FOF (free-of-form)! We’re not asking for any info about you. Enjoy our content and we hope one day you come back to fill in our one and only form – Contact Us!